Crypto Sentiment Slowly Improves From Extreme Fear — What’s Next?

Happy Friday,

The crypto market has shown initial signs of stabilization over the past week, after rebounding slightly from a brutal sell-off that had erased over a trillion dollars in total market capitalization.

After hitting multi-month lows, the recovery has been driven by dip-buying and short-term structure changes. Still, overall sentiment remains firmly in “Extreme Fear” territory.

The market is still grappling with the fallout from the previous week’s deep correction and macroeconomic uncertainties.

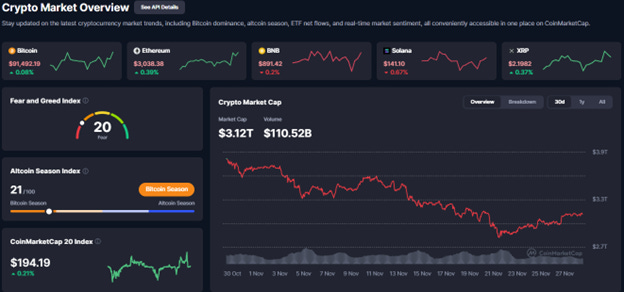

Crypto Market Overview

The overall market has started to recover from the lows of the correction but continues to be fragile.

Here are a few summary points to quantify the market.

Total Market Capitalization: The market is attempting to hold above its recent lows and is reading a $3.11 trillion figure.

Crypto Fear and Greed Index: The index has slightly recovered from a reading of 11 to around 20-25. While this shows an encouraging rise in confidence, the market continues to be classified as “Extreme Fear,” which is a level that often comes before capitulation or marks major cyclical bottoms.

The altcoin season index shows a reading of 21/100, which means that Bitcoin continues to hold the upper hand.

So far, Bitcoin’s dominance now sits at around 58%, while Ethereum’s holds 11.8%

Major Asset Price Update

Bitcoin (BTC)

After touching a multi-month low near $80,000, Bitcoin staged a recovery after pushing back above the $90,000 level. This pre-holiday rally saw a temporary 13% jump and analysts are watching the $100,000 - $105,000 range as the critical resistance to reclaim to avoid a harsher fall in prices.

Ethereum (ETH)

Ethereum has lagged behind Bitcoin’s recovery but found support recently. ETH bounced off the $2,700 - $2,800 area, which acted as a short-term trampoline for buyers. The asset is currently trading around $3,020 and institutional activity has provided some underlying support.

Solana (SOL)

Solana’s recovery has been choppy, with the price consolidating around $140 after briefly dropping to the $125 level. Institutional interest seems to be waning slightly, as Solana-focused investment products recorded their first single-day net outflow in the past week.

The Future of AI Agent Marketing Is Here

We are thrilled to announce the launch of VitaminAi, powered by VoiceOfCrypto! Our revolutionary search tool to simplify and supercharge your marketing campaigns.

General Market Developments

The past week’s market narrative has been a combination of several factors, both micro and macro.

ETF Flow Divergence: While the overall crypto market bled, institutional ETF flows showed a mixed picture. Bitcoin ETFs saw modest net inflows earlier in the week, but the overall trend has been more careful than usual.

Macro Environment: The correlation between the crypto market and traditional risk assets continues to be one of the most watched metrics so far.

Hopes of potential rate cuts for December have contributed to the recent bounce in BTC, despite the US market being shut for the Thanksgiving holiday.

Stablecoin Growth: The combined market ca of all stablecoins has reached a new all-time high, of more than $280 billion.

Contagion from AI Sell-off: The previous week’s contagion from the “AI bubble” burst in tech stocks (like Nvidia and Oracle) continues to weigh on the overall “risk-on” appetite for crypto

Market Insights and News

Bitcoin ETFs Just Flipped Green… and Institutions Are Quietly Loading Up

Bitcoin ETFs pulled in a strong comeback in terms of inflows on 25 November, especially after weeks of strong outflows.

New altcoin ETFs have also shown strong early traction and attracted institutional interest

Market flows currently show a change a shift toward a more balanced multi-asset approach

The current ETF market shows strong investor interest in ETPs, aside from assets related to the major cryptos.

Grayscale’s Dogecoin ETF Launches Today — But DOGE Sinks to a 7-Month Low at $0.14

Grayscale’s new Dogecoin ETF began trading on the NYSE earlier in the week.

Dogecoin now trades under major averages and needs strength above $0.165.

Traders are watching for a short rebound while long-term signals continue to show weakness.

Video of the Week

Why Are Enterprises Switching to Decentralized Cloud?

Enterprises are rethinking their reliance on AWS, Google, and Microsoft. In this episode, Sebastian from Impossible Cloud Network shares why decentralized cloud infrastructure is gaining traction—and how it ensures enterprise-grade performance, compliance, and data sovereignty.

That’s a wrap for today!

Don’t forget to follow VOC for the latest news and Analysis, and keep up with our content on Twitter, Facebook, Telegram, Instagram, and LinkedIn. For the latest video and daily wrap, subscribe to our YouTube Channel.

The shift from 11 to 20-25 on the Fear & Greed Index is encouraging, but staying in Extreme Fear teretory tells me we're probly not out of the woods yet. I'm suprised stablecoins hit a new ATH at $280B while everything else is bleeding. That feels like dry powder waiting on the sidelines. Do you think the institutional ETF flows will stabilze if Bitcoin holds above $90k or are we heading for more chop?